NYSE IPOs

GTS’ DMM business is a market leader in IPO listings on the New York Stock Exchange. We have a demonstrated track record of excellence partnering closely with companies as they embark on one of the most important and high profile events in their history. We work hand-in-hand with our IPO Issuers to provide education and advice for an exceptional IPO experience. From setting timing and trading expectations to educating executive management, the treasury and IR teams, and top shareholders, GTS stands side-by-side with our clients to ensure no detail is missed and that there are no surprises on this crucial day. Our IPO Issuers and their stakeholders leave appreciative of their successful once-in-a-lifetime event and armed with the knowledge they need to help operate a newly public company. Notable NYSE IPOs:

Photos courtesy of NYSE

Offering Size1: $22,000,000

Day 1 Mkt. Cap1: $8,019,611,500

IPO March 2024

IPO March 2024

GTS is proud to be selected as Reddit’s DMM

Offering Size1: $100,000,000

Day 1 Mkt. Cap1: $6,559,294,700

IPO February 2024

IPO February 2024

GTS is proud to be selected as Amer Sports’s DMM

Offering Size1: $19,200,000

Day 1 Mkt. Cap1: $8,250,797,100

IPO September 2023

IPO September 2023

GTS is proud to be selected as Klaviyo’s DMM

Offering Size1: $14,440,000

Day 1 Mkt. Cap1: $4,876,475,900

IPO June 2023

IPO June 2023

GTS is proud to be selected as Cava Group’s DMM

Offering Size1: $4,435,200,000

Day 1 Mkt. Cap1: $67,793,404,100

IPO June 2021

IPO June 2021

GTS is proud to be selected as DiDi Global’s DMM

Offering Size1: $562,500,000

Day 1 Mkt. Cap1: $6,010,302,200

IPO June 2021

IPO June 2021

GTS is proud to be selected as Mister Car Wash’s DMM

Offering Size1: $924,300,000

Day 1 Mkt. Cap1: $10,239,760,400

IPO June 2021

IPO June 2021

GTS is proud to be selected as Bright Health Group’s DMM

Offering Size1: $176,000,000

Day 1 Mkt. Cap1: $1,624,682,000

IPO May 2021

IPO May 2021

GTS is proud to be selected as SimilarWeb’s DMM

Offering Size1: $257,250,000

Day 1 Mkt. Cap1: $3,508,903,900

IPO March 2021

IPO March 2021

GTS is proud to be selected as Vizio Holdings’ DMM

Offering Size1: $564,000,000

Day 1 Mkt. Cap1: $7,070,949,000

IPO February 2021

IPO February 2021

GTS is proud to be selected as Signify Health’s DMM

Offering Size1: $1,398,000,000

Day 1 Mkt. Cap1: $45,838,342,500

IPO January 2021

IPO January 2021

GTS is proud to be selected as RLX Technology’s DMM

Offering Size1: $900,000,000

Day 1 Mkt. Cap1: $1,348,872,000

IPO January 2021

IPO January 2021

GTS is proud to be selected as Thoma Bravo Advantage (SPAC)’s DMM

Offering Size1: $225,000

Day 1 Mkt. Cap1: $261,500,000

IPO October 2020

IPO October 2020

GTS is proud to be selected as ION Acquisition (SPAC)’s DMM

Offering Size1: $741,960,000

Day 1 Mkt. Cap1: $5,079,196,400

IPO September 2020

IPO September 2020

GTS is proud to be selected as American Well Corp’s DMM

Offering Size1: $1,495,950,000

Day 1 Mkt. Cap1: $15,272,867,900

IPO August 2020

IPO August 2020

GTS is proud to be selected as Xpeng Inc’s DMM

Offering Size1: $1,722,600,000

Day 1 Equity Mkt. Cap1: $10,472,130,809

IPO July 2020

IPO July 2020

GTS is proud to be selected as Dun & Bradstreet’s DMM

Offering Size1: $800,000,000

Day 1 Mkt. Cap1: $7,400,963,300

IPO June 2020

IPO June 2020

GTS is proud to be selected as Albertsons’ DMM

Offering Size1: $39,600,000

Day 1 Mkt. Cap1: $222,968,680

IPO November 2019

IPO November 2019

GTS is proud to be selected as Silvergate Capital’s DMM

Offering Size1: $1,430,000,000

Day 1 Mkt. Cap1: $12,915,994,649

IPO April 2019

IPO April 2019

GTS is proud to be selected as Pinterest’s DMM

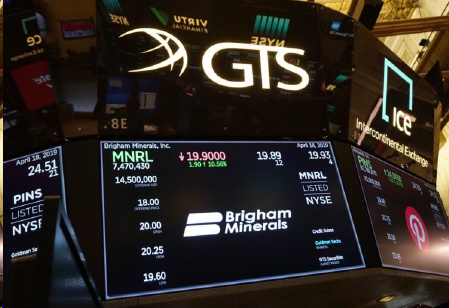

Offering Size1: $261,000,000

Day 1 Mkt. Cap1: $948,192,000

IPO April 2019

IPO April 2019

GTS is proud to be selected as Brigham Minerals’ DMM

Offering Size1: $217,680,000

Day 1 Equity Mkt. Cap1: $2,815,623,160

IPO April 2019

IPO April 2019

GTS is proud to be selected as Pagerduty’s DMM

Offering Size1: $623,333,339

Day 1 Mkt. Cap1: $8,640,148,317

IPO March 2019

IPO March 2019

GTS is proud to be selected as Levi’s DMM

Offering Size1: $200,000,000

Day 1 Mkt. Cap1: $200,000,000

IPO February 2019

IPO February 2019

GTS is proud to be selected as RMG’s DMM

Offering Size1: $45,000,000

Day 1 Mkt. Cap1: $357,923,300

IPO November 2018

IPO November 2018

GTS is proud to be selected as Weidai Ltd.’s DMM

Offering Size1: $56,000,000

Day 1 Mkt. Cap1: $266,349,760

IPO November 2018

IPO November 2018

GTS is proud to be selected as Vapotherm’s DMM

Offering Size1: $48,750,000

Day 1 Mkt. Cap1: $516,964,935

IPO November 2018

IPO November 2018

GTS is proud to be selected as CNFinance Holdings Ltd’s DMM

Offering Size1: $288,000,000

Day 1 Mkt. Cap1: $1,422,006,225

IPO October 2018

IPO October 2018

GTS is proud to be selected as YETI’s DMM

Offering Size1: $263,500,000

Day 1 Mkt. Cap1: $2,955,938,168

IPO October 2018

IPO October 2018

GTS is proud to be selected as Anaplan Inc’s DMM

Offering Size1: $340,000,000

Day 1 Mkt. Cap1: $2,426,710,000

IPO October 2018

IPO October 2018

GTS is proud to be selected as Livent’s DMM

Offering Size1: $252,000,000

Day 1 Mkt. Cap1: $4,864,491,030

IPO October 2018

IPO October 2018

GTS is proud to be selected as Elastic’s DMM

Offering Size1: $71,880,000

Day 1 Mkt. Cap1: $606,595,722

IPO September 2018

IPO September 2018

GTS is proud to be selected as Shanghai Liulishuo Information Technology Co., Ltd.’s DMM

Offering Size1: $884,870,000

Day 1 Mkt. Cap1: $8,243,526,478

IPO September 2018

IPO September 2018

GTS is proud to be selected as Farfetch’s DMM

Offering Size1: $1,510,000,000

Day 1 Mkt. Cap1: $12,822,840,000

IPO September 2018

IPO September 2018

GTS is proud to be selected as Elanco Animal Health Inc’s DMM

Offering Size1: $104,500,000

Day 1 Mkt. Cap1: $1,807,992,742

IPO September 2018

IPO September 2018

GTS is proud to be selected as X Financial’s DMM

Offering Size1: $1,000,000,000

Day 1 Mkt. Cap1: $6,771,666,304

IPO September 2018

IPO September 2018

GTS is proud to be selected as NIO’s DMM

Offering Size1: $44,000,000

Day 1 Mkt. Cap1: $1,395,254,917

IPO July 2018

IPO July 2018

GTS is proud to be selected as Cango’s DMM

Offering Size1: $637,500,000

Day 1 Mkt. Cap1: $2,778,772,898

IPO June 2018

IPO June 2018

GTS is proud to be selected as BJ’s DMM

Offering Size1: $455,000,000

Day 1 Equity Mkt. Cap1: $558,924,930

IPO June 2018

IPO June 2018

GTS is proud to be selected as Essential Property’s DMM

Offering Size1: $180,000,000

Day 1 Mkt. Cap1: $2,920,263,352

IPO June 2018

IPO June 2018

GTS is proud to be selected as Avalara’s DMM

Offering Size1: $122,400,000

Day 1 Mkt. Cap1: $1,957,905,894

IPO June 2018

IPO June 2018

GTS is proud to be selected as Puxin Limited’s DMM

Offering Size1: $88,230,000

Day 1 Mkt. Cap1: $360,789,852

IPO June 2018

IPO June 2018

GTS is proud to be selected as Charah Solutions’s DMM

Offering Size1: $108,000,000

Day 1 Mkt. Cap1: $505,613,161

IPO May 2018

IPO May 2018

GTS is proud to be selected as Inspire Med. Systems’ DMM

Offering Size1: $174,500,000

Day 1 Mkt. Cap1: $1,928,453,982

IPO April 2018

IPO April 2018

GTS is proud to be selected as Smartsheet’s DMM

Offering Size1: $555,000,000

Day 1 Mkt. Cap1: $3,937,791,446

IPO April 2018

IPO April 2018

GTS is proud to be selected as Pivotal Software’s DMM

Offering Size1: $154,000,000

Day 1 Mkt. Cap1: $2,070,164,440

IPO April 2018

IPO April 2018

GTS is proud to be selected as Zuora’s DMM

Offering Size1: $179,300,000

Day 1 Mkt. Cap1: $1,759,646,041

IPO March 2018

IPO March 2018

GTS is proud to be selected as OneSmart’s DMM

Offering Size1: $142,800,000

Day 1 Mkt. Cap1: $1,320,178,717

IPO March 2018

IPO March 2018

GTS is proud to be selected as GreenTree’s DMM

Offering Size1: $149,500,000

Day 1 Mkt. Cap1: $1,917,541,127

IPO March 2018

IPO March 2018

GTS is proud to be selected as Sunlands’ DMM

Offering Size1: $110,000,000

Day 1 Mkt. Cap1: $668,633,813

IPO February 2018

IPO February 2018

GTS is proud to be selected as Huami Corporation’s DMM

Offering Size1: $250,000,000

Day 1 Mkt. Cap1: $2,679,819,383

IPO February 2018

IPO February 2018

GTS is proud to be selected as Central Puerto S.A.’s DMM

Offering Size1: $351,000,000

Day 1 Mkt. Cap1: $2,193,555,338

IPO February 2018

IPO February 2018

GTS is proud to be selected as FTS International’s DMM

Offering Size1: $748,940,000

Day 1 Mkt. Cap1: $1,628,195,008

IPO February 2018

IPO February 2018

GTS is proud to be selected as Hudson Group’s DMM

Offering Size1: $1,210,000,000

Day 1 Mkt. Cap1: $7,536,673,300

IPO February 2018

IPO February 2018

GTS is proud to be selected as VICI Properties’s DMM

Offering Size1: $485,710,000

Day 1 Mkt. Cap1: $2,624,365,097

IPO February 2018

IPO February 2018

GTS is proud to be selected as Corporacion America’s DMM

Offering Size1: $731,500,000

Day 1 Mkt. Cap1: $5,253,530,193

IPO January 2018

IPO January 2018

GTS is proud to be selected as Gates Industrial Corporation’s DMM

1.) Source: Company Filings, Bloomberg, and Thomson Reuters

© 2025 GTS. All rights reserved. Broker-dealer services are provided in the United States by GTS Securities, LLC and GTS Execution Services, LLC, each of which is an SEC-registered broker dealer and member of FINRA. Certain regulated activities are undertaken in Europe by GTS Securities Europe Ltd., a firm authorized and regulated by the U.K. Financial Conduct Authority. GTS Digital LLC is a cryptocurrency and digital assets trading firm. The content on this website is for informational purposes only, and you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this website constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. GTS and its marks are registered trademarks of GTS.